Airline bag fees are going up again. Here's why

Originally published on Substack.

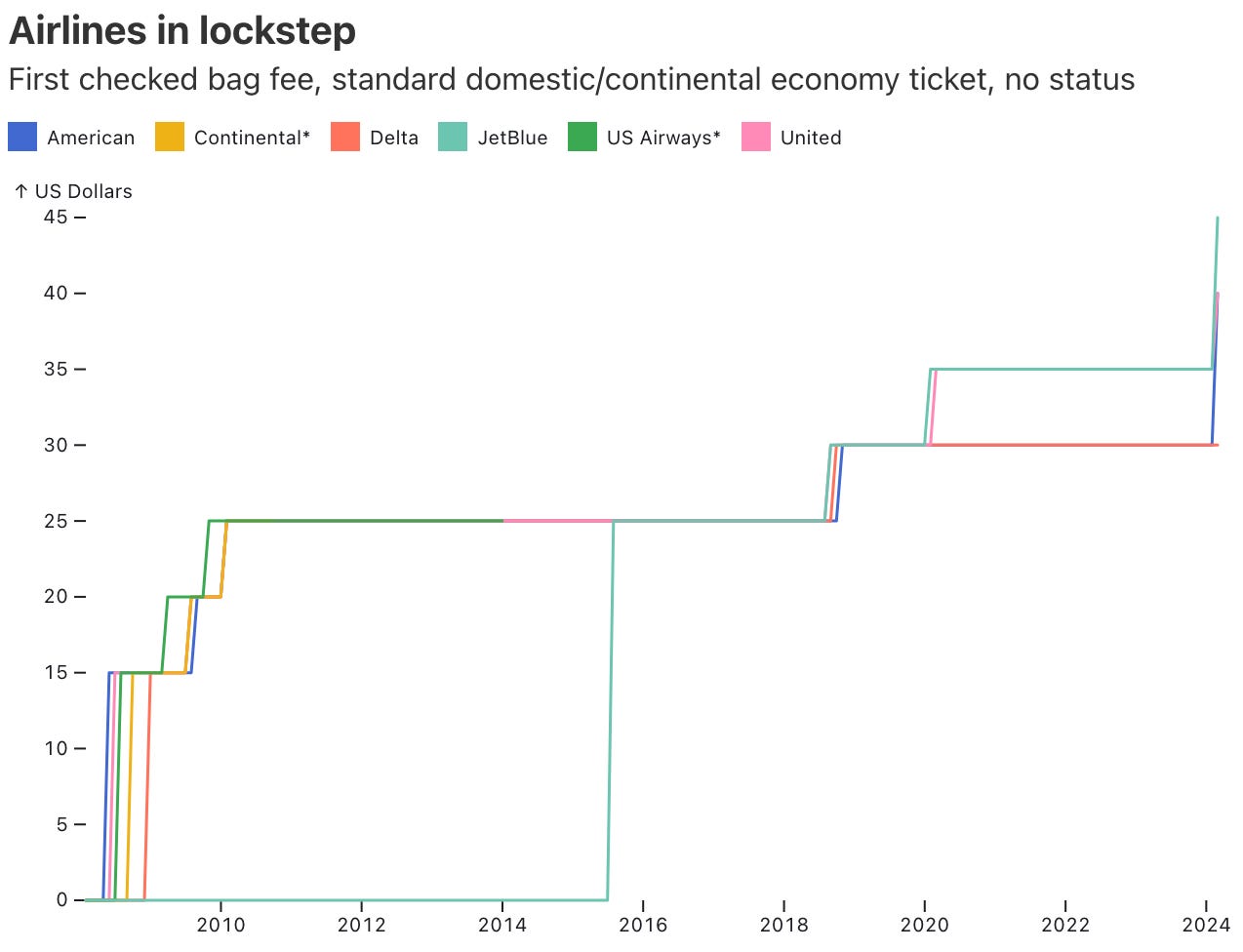

It’s the time of the decade when US airlines are raising bag fees again. Since December 2023, Alaska Airlines, American Airlines, JetBlue, and United Airlines all have increased their fees to check a bag by $5-10. Why is this happening now? The simple answer is because they can. The airline industry is an oligopoly and history shows that when one airline raises their bag fee, others shortly follow.

*Pre-merger. Sources: Airline websites (live and archived); news articles.

*Pre-merger. Sources: Airline websites (live and archived); news articles.

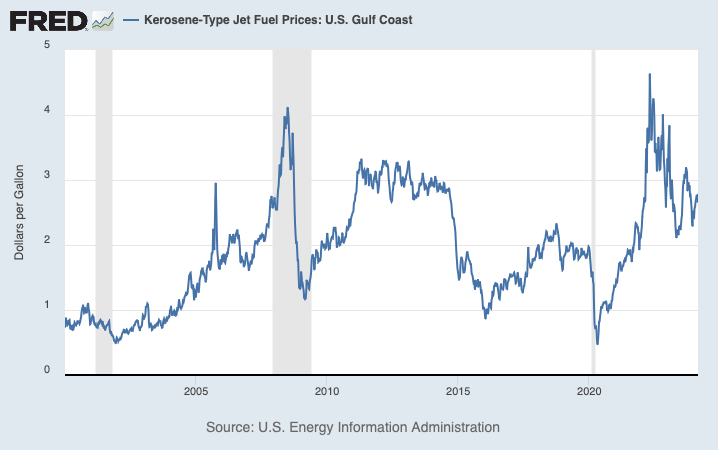

Fifteen years ago, checked bag fees were limited to heavy or oversized items, or an excessive number of items. That all changed in May 2008 when American Airlines introduced a $15 fee for the first checked bag as high fuel prices compressed airline margins. Most major US airlines quickly followed suit. After a few rounds of tweaks and hikes, checked bag fees settled at $25 for much of the 2010s. Naturally, these fees did not go away even when fuel prices stabilized.

Source: US EIA via FRED.

Source: US EIA via FRED.

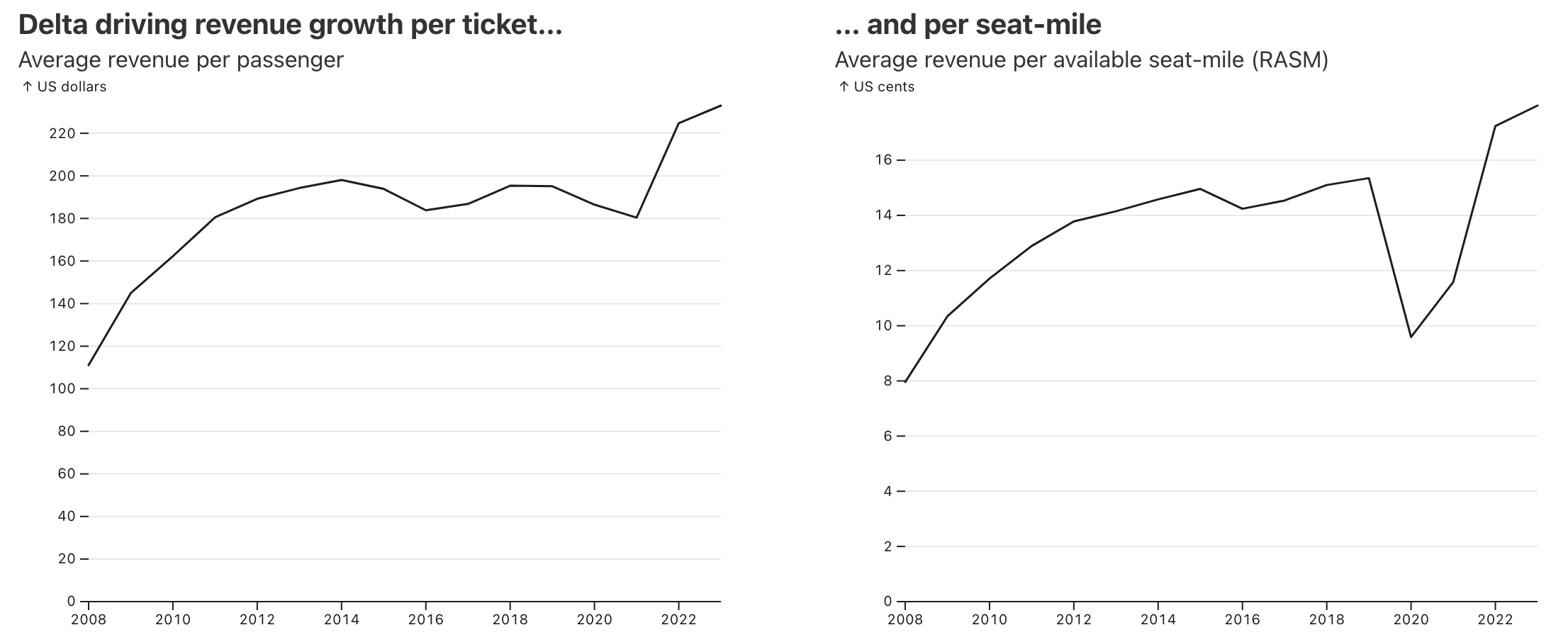

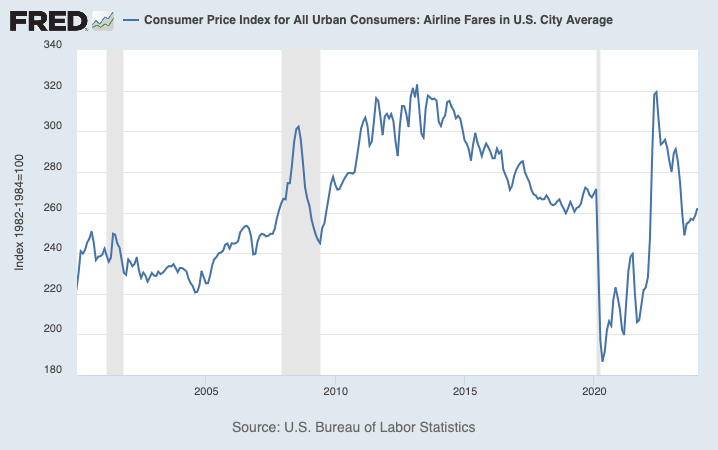

Bag fees, alongside the introduction of food and drink purchases and expansion of credit-card partnerships has created new revenue sources for airlines—or, seen more shrewdly, allowed them to raise the effective fares paid per passenger without raising the “base ticket price.” Between 2008 and 2023, Delta Air Lines grew its average revenues per passenger and average revenues per seat-mile by 109% and 125%, respectively, even as the airline fares component of CPI was almost unchanged.

Sources: Delta Air Lines financial reports; calculations by Christian Zhang.

Sources: Delta Air Lines financial reports; calculations by Christian Zhang.

Source: US BLS via FRED.

Source: US BLS via FRED.

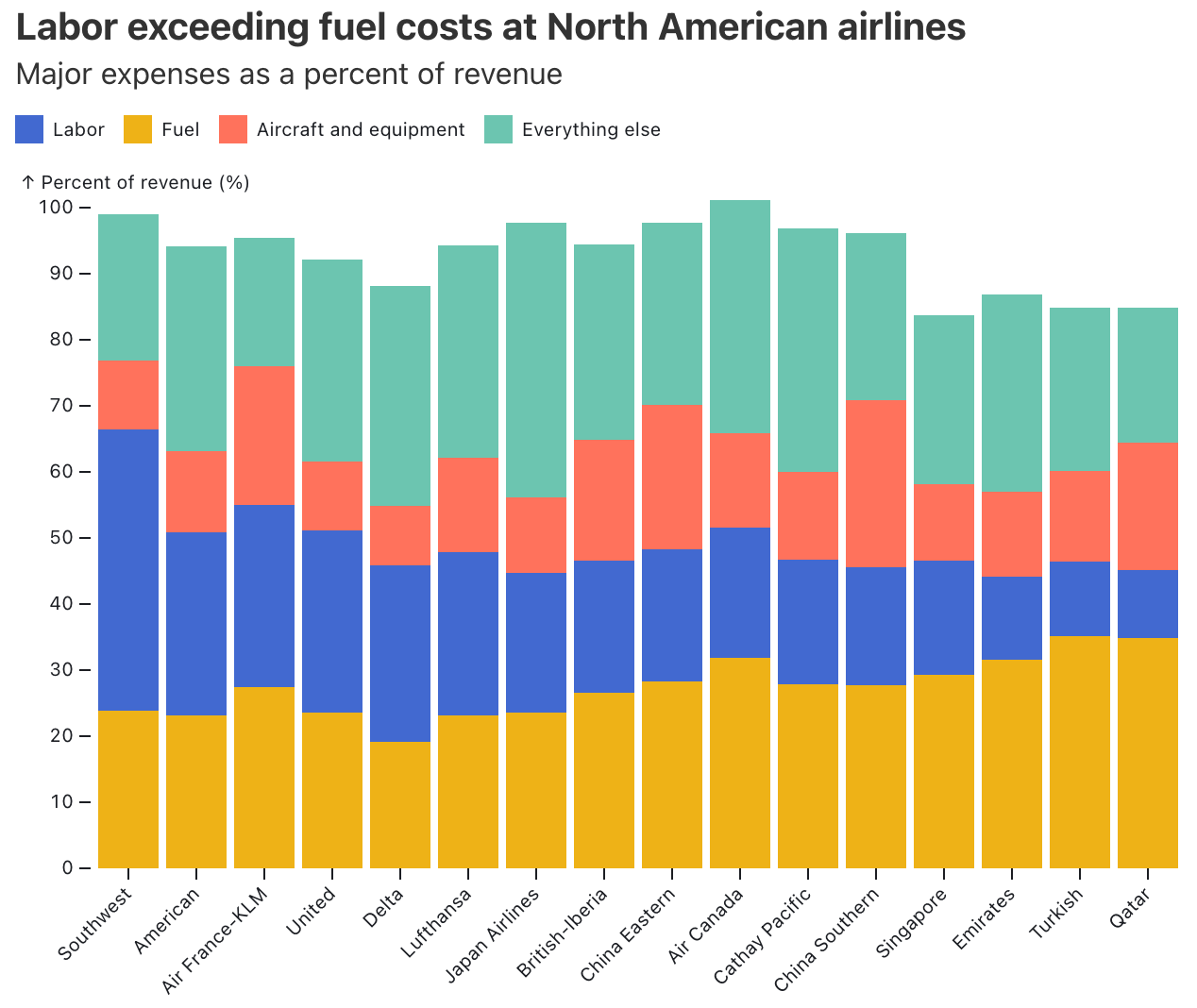

Airlines are in a difficult line of business. Ticket prices are still competitive enough, and demand is seasonal and sensitive to economic cycles and the occasional social media, political, or engineering kerfuffle. Airlines are, at once, restaurants, hotels, transport providers, and banks. On the cost side, airlines exert relatively little control on their spending: one third for fuel, another third for employees, and one quarter for aircraft equipment (whether financed, owned and depreciated, or leased).

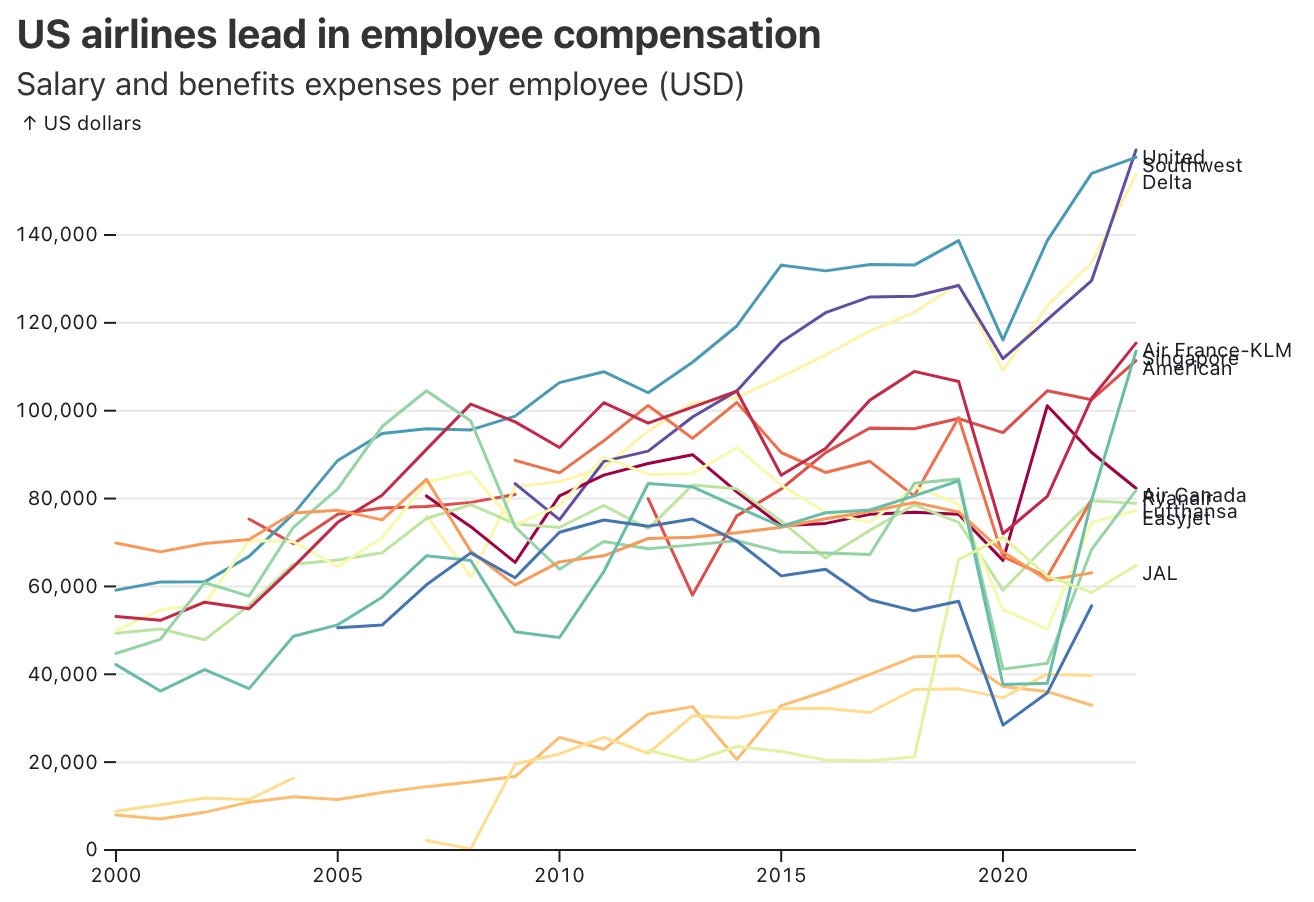

In particular, labor costs are rising rapidly amid a persistent pilot shortage and generous new union contracts. At Delta, Southwest, and United, labor costs divided by the number of employees (an imperfect measure of average salaries) have more than doubled from around $60-70,000 in 2007 to $150,000 in 2023. Pilot salaries in particular are at all-time highs: as of January 2024, captains at Delta can earn more than $350 per flying hour, equivalent to over $300,000 per year. Flight attendants, who currently earn $50-70,000 per year, are also pushing for higher salaries and benefits.

Sources: Airline financial reports. Calculated by dividing reported salary and labor costs by reported full-time equivalent employees.

Sources: Airline financial reports. Calculated by dividing reported salary and labor costs by reported full-time equivalent employees.

Incidentally, this is probably one reason why some foreign airlines are perceived to have better service. Asian and Middle Eastern airlines, which pay their non-unionized workers 20-50% less than US and European airlines, can have more staff and have more money left over to spend on frills like free checked bags and meals. Labor cost pressures are also behind staffing shenanigans like regional airlines in the US and country-specific operating subsidiaries in Europe, both attempts to circumvent legacy union contracts and offer lower salaries to junior pilots and flight attendants.

Source: Latest airline financial reports (FY2022 or FY2023). Aircraft and equipment includes depreciation, lease, and maintenance/repair expenses.

Source: Latest airline financial reports (FY2022 or FY2023). Aircraft and equipment includes depreciation, lease, and maintenance/repair expenses.

I’m reminded of the adage that all of your costs represent other people’s incomes, and rising labor costs (or employee salaries) at airlines is a clear illustration of this. Safety and regulatory considerations—you can’t have fewer than two pilots in the cockpit, for example–means that staffing levels will continue to scale linearly with service levels. As customers, we should continue to expect higher fees, more “optional services” and smaller seats (in economy, at least) for some time to come.